16+ Monthly mortgage

How mortgage rates have changed over time. A mortgage plan where half the scheduled monthly payment is made twice a month.

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

Check out the webs best free mortgage calculator to save money on your home loan today.

. Despite overall savings 15-year mortgage borrowers will spend considerably more on their monthly payments than 30-year mortgage borrowers. If you know the specific amount of taxes add as an annual total. This plan is not to be confused with a bi-weekly plan where half the.

P Monthly payment amount. At 1663 a 200000 mortgage has a monthly cost for principal and interest of 2800. Lock Your Rate Now With Quicken Loans.

But with a bi-weekly mortgage. Protect Yourself From a Rise in Rates. Enter the monthly payment the interest rate and the loan length in years.

Save Time Money. Lenders provide an annual interest rate for mortgages. Protect Yourself From a Rise in Rates.

For example if you pay 1200 once per month as your entire monthly. 2 days agoThe 30-year fixed-rate mortgage averaged five-point-89-percent last week up from less than three percent this time last year. Todays mortgage interest rates are well below the highest annual average rate recorded by Freddie Mac 1663 in 1981.

Compare Offers Side by Side with LendingTree. On average payments for 15. A 56943 increase hits hard on your monthly budget but also consider the additional total costs over a year.

Thats a maximum loan amount of roughly 253379. The median monthly mortgage payment in the US. Get Instantly Matched With Your Ideal Mortgage Loan Lender.

Compare Your Best Mortgage Loans View Rates. Ad Were Americas 1 Online Lender. Lock Your Rate Now With Quicken Loans.

The 10 States With the Worst Quality of Life The average mortgage loan rate for a conforming 30-year fixed-rate mortgage decreased from 430 to 420 the. So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000. Ad Get the Right Housing Loan for Your Needs.

While each payment is equal to half the monthly amount you end up paying an extra month per year with this method. For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income. Well Help You Find the Loan that Meets Your Home Purchase or Refinancing Needs.

Find Out Which Mortgage Loan Lender Suits You The Best. To help you see current market conditions and find a local lender current Redmond 15-year and current Redmond 30. If I pay 1500 per month how much of a mortgage loan will that be.

T Total number of. P Vn1 nt1 nt - 1 Where. The mean or average monthly mortgage payment for US.

This calculator figures monthly home payments for 15-year loan terms. Browse Information at NerdWallet. Compared with the long-time.

Ad Top Home Loans. The average mortgage rate in 1981 was 1663 percent. See the results for Free refinance calculator mortgage in Huntington.

Top 10 Mortgage Lenders To Finance Your New Home. Lender Mortgage Rates Have Been At Historic Lows. Ad Access a Wide Range of Mortgage Products with Exceptional Service.

Over the 30-year life of the loan youll pay. That is due to median prices hovering well over. See all refinance rates.

Joes total monthly mortgage payments including principal interest taxes and insurance shouldnt exceed 1400 per month. 7 hours agoThe Bank of England said on Wednesday that it would delay the publication of its monthly bank and building society lending data by a day until Sept. Ad Were Americas 1 Online Lender.

To use it all you need. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current. Ad How To Get a Mortgage.

Updated May 10 2022. For today Tuesday February 15 2022 the average rate for a 30-year fixed mortgage is 420 an increase of 27 basis points since the same time. The formula used to calculate monthly principal and interest mortgage payments is.

Take Advantage And Lock In A Great Rate. 30 due to a public holiday. Ad 10 Best Mortgage Lenders of 2022.

V Loan amount. To calculate how much house you can afford use the 25 rule never spend more than 25 of your monthly take-home pay on monthly mortgage payments. Is 1100 based on the most recent American Housing Survey data provided by the US.

Homeowners is 1487 according to the latest. Using our Mortgage Balance Calculator is really simple and will immediately show you the remaining balance on any repayment mortgage details you enter. The calculator will tell you how much the loan.

If you want to do the monthly mortgage payment calculation by hand youll need the monthly interest rate just. Compare Reviews Lock In A Low Interest Rate. The total is divided by 12 months and applied to each monthly mortgage payment.

Ad Learn More About Mortgage Preapproval.

Free 10 Loan Payment Contract Samples In Pdf

16 Loan Schedule Templates In Google Docs Google Sheets Xls Word Numbers Pages Free Premium Templates

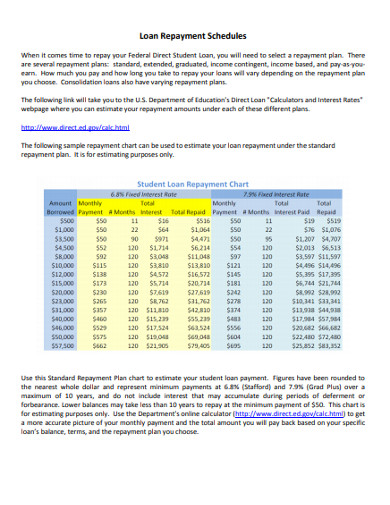

Repayment Schedule 10 Examples Format Pdf Examples

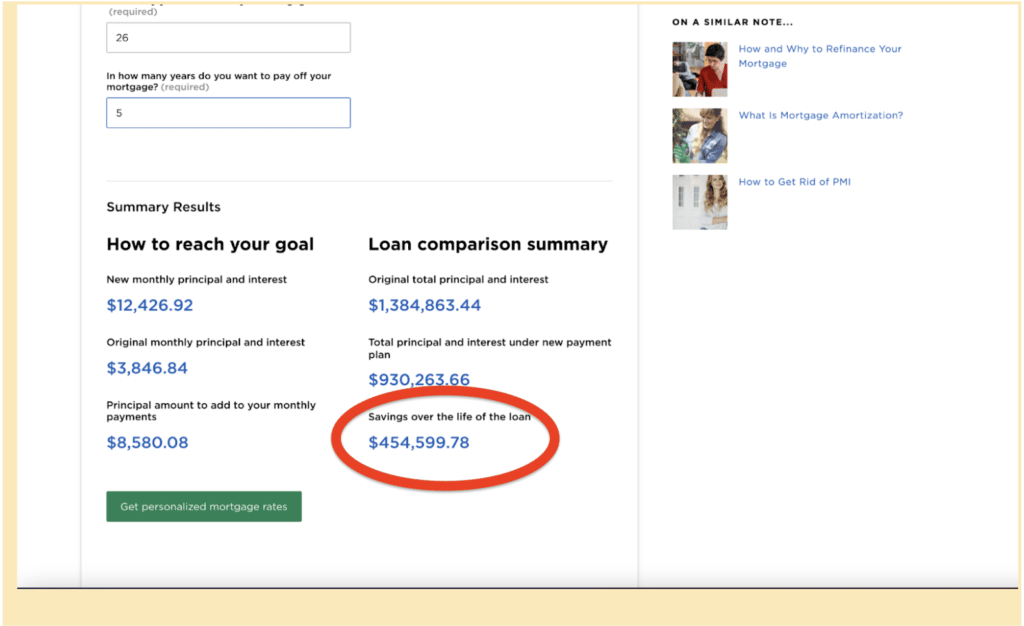

My Plan To Pay Off My Mortgage Early What Mommy Does

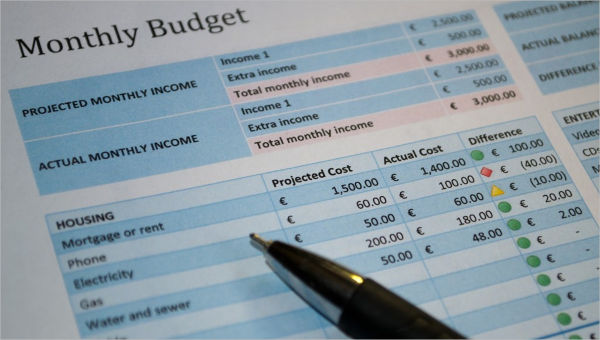

16 Monthly Budget Templates Word Pdf Excel Free Premium Templates

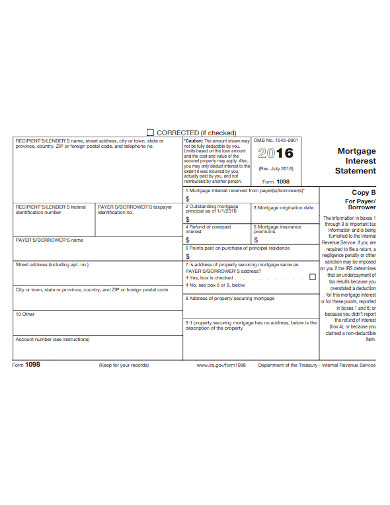

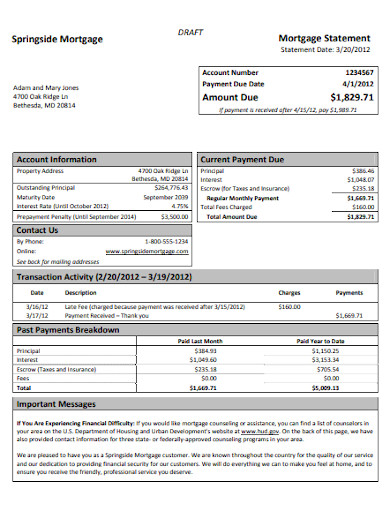

Mortgage Statement 10 Examples Format Pdf Examples

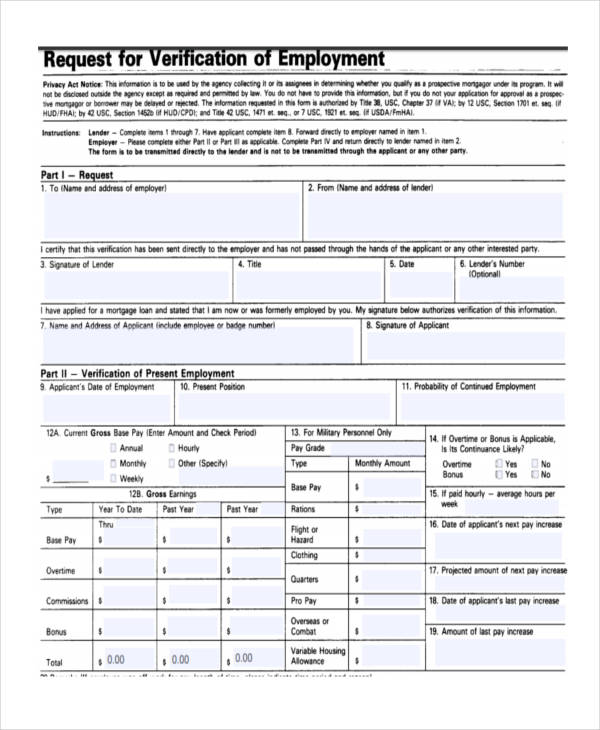

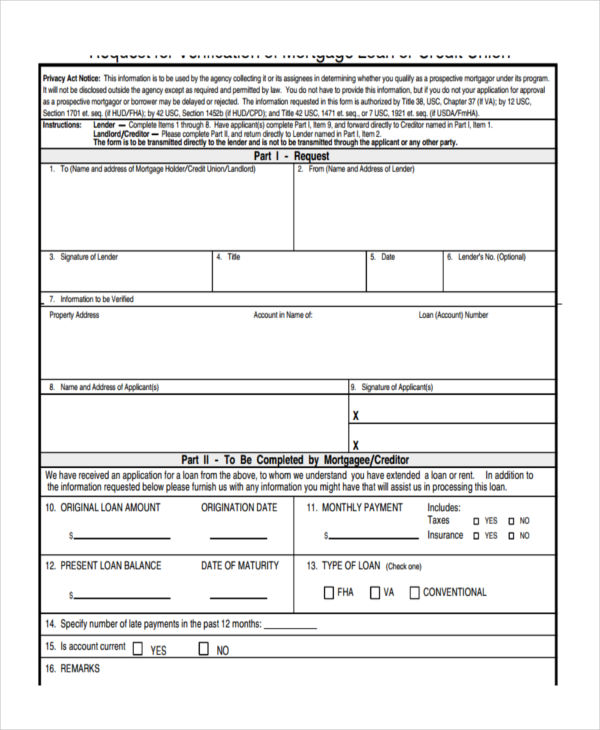

Free 8 Sample Mortgage Verification Forms In Pdf Ms Word

Mortgage Statement 10 Examples Format Pdf Examples

Ways To Pay Off Your Mortgage Early And Why We Did It

16 Free Payment Schedule Templates Word Excel And Pdf

Current First Tech Mortgage Rates Review Mortgage Products And More

Mortgage Statement 10 Examples Format Pdf Examples

Mortgage Statement 10 Examples Format Pdf Examples

Free 8 Sample Mortgage Verification Forms In Pdf Ms Word

Ways To Pay Off Your Mortgage Early And Why We Did It

Mortgage Statement 10 Examples Format Pdf Examples

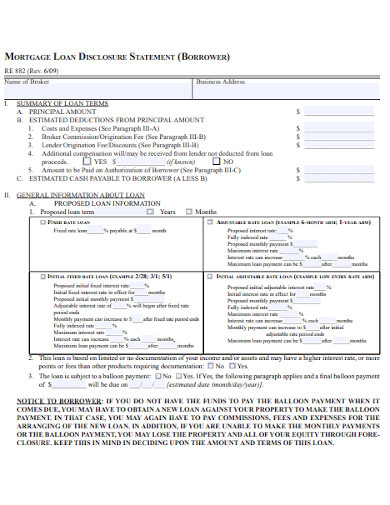

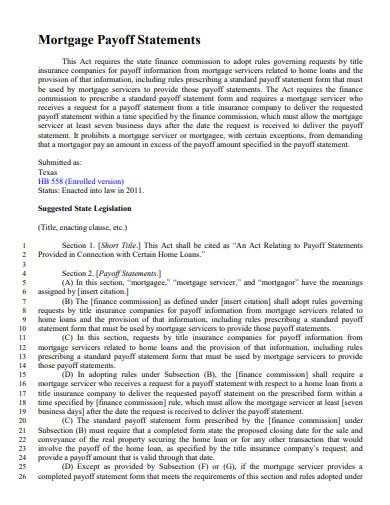

Free 16 Mortgage Agreement Contract Samples Templates In Pdf Ms Word